|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding FHA Loan NYC: A Comprehensive GuideFor many aspiring homeowners in New York City, navigating the mortgage landscape can be daunting. Among the various options, the FHA loan is a popular choice due to its accessible requirements and benefits. This article provides a detailed overview of FHA loans in NYC, covering essential aspects to help you make informed decisions. What is an FHA Loan?The Federal Housing Administration (FHA) loan is a government-backed mortgage designed to make homeownership more accessible, especially for first-time buyers. It allows for lower down payments and more flexible credit requirements compared to conventional loans. Key Features of FHA Loans

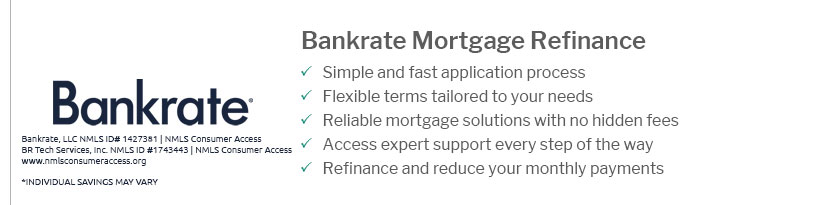

Eligibility CriteriaTo qualify for an FHA loan in NYC, borrowers must meet specific requirements. These include having a steady employment history, a valid Social Security number, and proof of U.S. residency. Additionally, the property being purchased must meet certain safety standards. Income and EmploymentApplicants need to demonstrate consistent income and stable employment. While there is no set income limit, lenders will evaluate your debt-to-income ratio to ensure you can comfortably manage monthly payments. Benefits of FHA Loans in NYCFHA loans offer numerous advantages, especially in a high-cost area like New York City. They provide a viable path to homeownership for those who might not qualify for traditional loans due to financial constraints. Accessible for First-Time BuyersFirst-time buyers often benefit from FHA loans due to the lower initial costs. It's worth exploring the best mortgage lenders in Albany NY for competitive offers. Refinancing OpportunitiesFHA loans also provide opportunities for refinancing, which can be beneficial if you're looking to reduce interest rates or monthly payments. Check out the best house refinance rates available to optimize your loan terms. FAQWhat is the minimum credit score required for an FHA loan?The minimum credit score for an FHA loan is 580 for a 3.5% down payment. However, borrowers with a score between 500-579 may qualify with a 10% down payment. Can I use an FHA loan for a multi-family property in NYC?Yes, FHA loans can be used to purchase 1-4 unit properties, allowing you to live in one unit while renting out the others. This can be a strategic way to offset mortgage costs. Are there any limits on the amount I can borrow with an FHA loan?Yes, FHA loan limits vary by county and are based on median home prices. In high-cost areas like NYC, limits are higher to accommodate the market. https://www.newamericanfunding.com/loan-types/fha-loan/state/new-york/

To qualify for an FHA loan in New York, you must meet the above requirements. You must have a credit score of at least 500. Your DTI must be less than 57%. You ... https://www.lendingtree.com/home/fha/fha-loan-limits-in-new-york/

For 2025, FHA loan limits for single-family homes range from $524,225 to $1,209,750 nationwide. Higher limits also apply for multifamily properties with two to ... https://www.nyc.gov/site/nycha/residents/homeownership-program.page

NYCHA utilized these properties as additional public housing, while working with tenants so they could become eventual homeowners of the properties. In the past ...

|

|---|